The Future of Polyurea Coatings

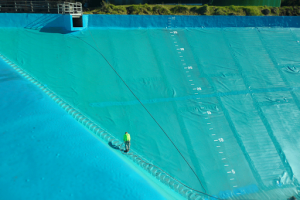

Polyurea is frequently used as a waterproofing sealant and corrosion-resistant coating on metals and concrete surfaces. Its applications include construction, rail and roadway transport, bridges, boats and ships, autos, oil and gas structures, and equipment. We will discuss its extensive uses as well as the future of this amazing product in this article today.

Introduction of the Polyurea Market

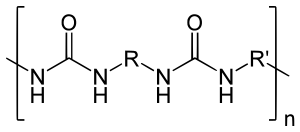

Polyurea is produced from aliphatic and aromatic types of isocyanates as a basic material. Both pure polyurea and hybrid product formulas are commercially available. (Related reading: The Advantages of Pure Polyurea Coatings for Protecting Water Treatment Plant Infrastructure.) These items can be applied manually, by hand mixing, putting or as a spray coating.

The global polyurea market is segmented on the basis of:

Type of product (pure polyurea versus hybrid).

Significant polyurea producers and competitive strategy.

We will take a look at each of these in more detail in the following sections.

Raw Materials are used to Produce the Product.

The raw materials are either aliphatic isocyanates or aromatic isocyanates. Polyurea items based upon aromatic isocyanates typically dominate the market because of their fundamental benefits and physical features, such as exceptional rust resistance and abrasion resistance, which are required for coating boat hulls and other marine applications, constructing floors, wall building, and construction and machinery. (A more detailed discussion of polyurea in marine environments can be discovered in the article Flexible Coatings for Protection of Marine Structures.).

The main downside of using aromatic isocyanate as a basic material is that the color and shine are negatively impacted by the sun’s ultraviolet rays (UV). Aliphatic polyurea is utilized for applications where color stability is necessary.

Application Technology.

Developments in spray technology have popularized polyurea; hence, other finishings, such as epoxy finishes, are being quickly changed by polyurea spray coatings. The primary advantages of a spray system are the speed of application, quickness of curing and precision of the resulting coating thickness.

Geographical Regions.

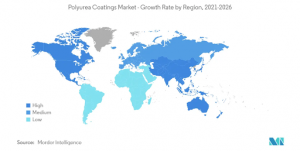

Polyurea markets are broadly classified into the following areas:.

North American.

European.

Asia Pacific.

Middle East and Africa.

South American.

With roughly 35% of the global intake, North America leads the other regions. Asia Pacific comes in second with 30%, Europe comes in third with 20%, and the Middle East and Africa come in fourth with 10%. The Asia Pacific area is expected to grow the fastest, with notable growth in emerging economies such as Malaysia, Vietnam, Indonesia, Taiwan, China and India. A few of the Asia-Pacific countries have the advantages of lower labor costs, access to basic materials, tax advantages and less strict environmental policies.

End User (Applications) Segments

End users are divided into the following categories:.

Building, housing and general construction.

Transportation.

Marine (boats, ships, ocean liners).

Oil and gas.

Facilities.

Industrial.

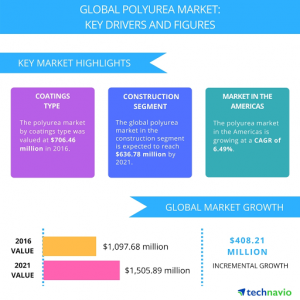

The growing need for developing construction and housing, driven by the rise in urbanization, is anticipated to supply momentum for market demand development for polyurea products. Lots of South American countries are investing in building and construction tasks. The emerging economies of the Asia Pacific region are likewise expected to continue their investments in infrastructure, thus triggering a growth in demand for polyurea coatings.

Transportation is another sector driving the growing demand for polyurea based on aromatic isocyanate.

Due to the Covid-19 pandemic, there is speculation that demand will increase for private automobiles such as cars and two-wheelers in many countries as people choose to take a trip in their own vehicles and avoid mass transit.

Kind Of Product (Pure Polyurea versus Hybrid Polyurea-Polyurethane).

Pure polyurea has much better moisture resistance and temperature resistance, whereas hybrid polyurea has superior adhesion on concrete and metal surface areas. Hybrid polyurea also has superior abrasion resistance and is preferred for specific applications, such as constructing construction equipment. Hybrid polyurea has a cost advantage over pure polyurea and is expected to get a significant share of the global market.

Significant Polyurea Producers and Competitive Strategy.

A few of the leading polyurea makers and solution companies consist of:.

BASF, Teknos and Voelkel Industrial items, GmBH (VIP).

Kukdo Chemical Co. Ltd., Covastro, Huntman International.

PPG Industries, Sherwin-Williams.

Rhino Linings Corporation, Wasser Corporation.

Armothane Inc., Versa Flex Inc., and Nucoat Coating Systems.

Due to technical barriers, consumers cannot quickly switch from one supplier to another due to the fact that the after-sale technical services component is crucial for the procedures handled by the client. Polyurea brand names in the global market are undoubtedly built on the basis of item innovations and exceptional control of crucial quality assurance specifications. Developing new solutions for polyurea—customized to the customer’s unique challenges—is the main technique of the major players in the market.

Why Demand for Polyurea Is Expected to Grow.

The need is anticipated to increase for a range of factors, as explored below.

Development in Building and Infrastructure Construction.

The structure construction section is expected to lead the global need.

Asia Pacific polyurea demand is now growing at a much faster rate than other regions, to the degree that its market volume is comparable to the North American volume.

In North America, the polyurea facilities market is typically utilized to waterproof structures such as bridges and parking decks and for deterioration preventative coatings for pipelines and highways.

Polyurea is used as a water-proofing material to safeguard bridge structures that require upkeep. The need continues to grow as more bridges are added to the list of deficient structures. The United States alone has more than 612,000 bridges, and it has actually been estimated that one-third of them need repair or replacement. The remaining bridges may require an extensive examination and repair work or replacement.

According to one report, in 2015, the United States topped worldwide polyurea usage at 27.91%, while China consumed another 15.92%. Europe was the other significant customer. Structure building, bridge and infrastructure waterproofing, and the transport sector continue to drive the need for polyurea finishes in these 3 areas.

The polyurea market is estimated to broaden from the present expense of USD 885 million to USD 1.485 billion. The development rate is anticipated to be 10% CAGR. The expansion of facilities, maintenance, general building and construction, landscaping, railroad transport and other industries is expected to drive the development.

Regulatory Factors.

Regulatory requirements and growing ecological awareness are compelling buyers to prefer environment-friendly polyurea coating items without any unpredictable natural substances (VOCs). High-quality item offerings by international polyurea producers have caused a shift in buyer preference in favor of long-lasting, cost-efficient and top-quality products.

Technological Developments.

The application portfolio for polyurea is growing continuously because of technological advancements, consisting of innovations in product science and application strategies and equipment.

Despite their high basic material expense, polyurea systems become extremely economical due to their quick curing (even at low temperatures, irrespective of high humidity conditions) and superior physical-chemical properties that can be tailored to unique application requirements. For certain end-user requirements, polyurea is typically the only practical option. Because the polyurea finishes are absolutely devoid of VOCs, they are certified to meet regulatory requirements.

Population Trends.

Populations have actually been growing in tier-2 and tier-3 cities all over the world, resulting in a fast development in metropolitan facility requirements such as airports, railways, streets, flyovers, bridges, malls and parking centers, together with the need for petroleum products and shipping. These factors continue to drive the development of demand for polyurea coatings.

Positive double-digit development rates are anticipated as new polyurea systems continue to change contending finishes, such as epoxy systems that do not cure as rapidly or endure variable temperature and humidity conditions. New applications are being discovered for these finishes on a constant basis.

Benefits and Advantages of Polyurea.

The advantages and benefits offered by polyurea finishings over comparable coverings such as epoxy include a mix of functions such as exceptional surface strength, hydrophobic (water repellent) qualities, high tensile load capability, and inertness with a lot of chemicals. Besides the flexibility and feasibility of creating and customizing the different item features, polyurea systems also make it possible to use fibers for reinforcement.

Elements Inhibiting Polyurea Demand.

Regrettably, using polyurea requires costly spray devices and experienced labor. The preliminary expense is high, but considering polyurea’s higher efficiency and toughness, these finishes can be considered cost-effective.

The COVID-19 pandemic requirements need to be thought about. According to one report, the pandemic temporarily interrupted the supply chain and polyurea production, and overall market demand is lower. While developing construction has been negatively impacted around the world, the marketplace is expected to recover quickly.

Factors Increasing Polyurea Demand.

The leading industry players are planning to increase polyurea production in the Asia Pacific area, and North American and European producers are even transferring a few of their factories to the Asia Pacific area due to the advantages of lower production expenses, lower raw material expenses, and proximity to booming markets. The area is expected to have steady demand growth due to a rise in nonreusable income among the middle and upper-middle-class segments, resulting in a greater rate of economic advancement and growth. Since customers appreciate the value of a quality, durable coating, the need for polyurea is gradually increasing. In addition, there are higher public costs associated with facilities projects such as roadways and bridges.

For example, Voelkel Industry Products (VIP) partnered with BASF to develop polyurea technology and brand-new polyurea solutions. VIP has also set up joint ventures in Hong Kong and India. VIP licensed production is beginning in South Africa, and a VIP subsidiary in Dubai has been developed to expand polyurea markets outside Germany.

Conclusion.

The need for polyurea is expected to progressively increase as brand-new polyurea coating systems continue to replace alternative finishes. New applications are being continuously established for these polyurea coverings, changing some of the competing coatings. Infrastructure costs in emerging economies such as the Asia-Pacific area are creating additional demand for polyurea. Increasing populations in tier-2 and tier-3 cities is resulting in a building and construction boom of roadways, bridges, homes, shopping centers, tunnels, rail transport systems, airports and shipping ports, all of which drive a progressively growing demand for polyurea coverings and linings.